Federal Direct Loans

CSU, San Bernardino participates in the Federal Direct Loan Programs through the Department of Education. Students, who are undergraduate, teacher credential and graduate students, enrolled at least half-time are eligible to borrow.

Eligible students must be admitted, in good academic standing and enrolled in a program leading to a degree or teaching certificate. The loans awarded are either subsidized, unsubsidized or a combination of both. The type and amount of loans offered will be determined by a student’s financial eligibility, dependency status, grade level, and overall aggregate limits of previously borrowed funds. Graduate students are only eligible for Unsubsidized Loans.

Borrow Wisely

Although a Direct Loan is a convenient source of additional funding for education, it is a loan that will be repaid with interest. It is important to budget and borrow carefully:

- Consider ways to keep educational costs down in order to limit total loan debt.

- Borrow only what is needed. Loans must be repaid with interest and depending on the type of loan, can begin accumulating immediately upon disbursement of the loan.

- Before borrowing, a student should use the Department of Education’s Budget Calculator to estimate both the amount of debt he/she may be able to afford and the potential monthly loan payment after he/she graduates.

- Direct Loans provide the borrower with delayed repayment while in-school and flexible repayment options for when he/she enters into repayment.

Remember: A borrower is obligated to repay his/her loan regardless of whether he/she completes his/her education is satisfied with his/her education, or is able to find a job.

Subsidized Direct Loan

A subsidized loan is a government insured, long term, low interest loan for eligible undergraduate students and is awarded on the basis of financial need. The federal government will pay (subsidize) the interest on the loan while the student remains enrolled in college at least half-time or more. For borrowers who have funds disbursed after July 1, 2012, the interest will be paid (subsidized) only while the student is enrolled at least half-time but not during the six-month grace period prior to repayment.

Graduate students are not eligible to borrow a Subsidized Direct Loan.

Maximum Eligibility Period for Subsidized Direct Loans:

Congress enacted the 'Moving Ahead for Progress in the 21st Century Act' which established time limitations on Stafford Subsidized student loans. This law will be effective for first time borrowers or borrowers who have paid off their loans prior to July 1, 2013 and are borrowing again.

This law allows students to receive Subsidized loans only within 150% of the length of their program of study. Once a student has reached this limit, he/she is no longer eligible to receive Subsidized student loans. If the student loses eligibility for Subsidized loans, he/she may still quality for an Unsubsidized loan which accrues interest while the student is in school since this time limit does not apply to Direct Unsubsidized Loans or PLUS Loans.

| Bachelor Degree Program | Credential Certification Program |

|---|---|

| 6 Year Maximum | 1.5 Year Maximum |

| 150 percent of 4 years = 6 years | 150 percent of 1 year = 1.5 years |

A student's maximum eligibility period can change if he/she changes or progresses to a program that has a different length. Direct Subsidized Loans borrowed for a previous program will count toward a student's current program limit.

For additional information, please review Time Limitations on Direct Subsidized Loans

Unsubsidized Direct Loan

An Unsubsidized loan is a government insured, long term, low interest loan for eligible undergraduate and graduate students. It is generally offered to students who do not qualify for need based aid or who need loan assistance beyond the maximums provided by the Subsidized Loan program.

Unlike a subsidized loan, the borrower is responsible for paying the interest from the time the unsubsidized loan is disbursed until it's paid in full. Borrowers have the option of paying the interest or deferring it while in college. If borrowers choose to defer the interest, it will be capitalized, which means it is added to the principal amount borrowed. Future interest will be calculated on the higher loan amount. It is to a borrower’s advantage to pay the interest while attending college.

How to Apply for Direct Loans

For either type of loan, a student must first complete a Free Application for Federal Student Aid (FAFSA®) for the academic year in which they are requesting financial assistance. After the FAFSA® is processed, the Office of Financial Aid and Scholarships will inform the student about his/her loan eligibility via an award. A student may view, accept or decline, all or in part, the Direct Loans offered to him/her via MyCoyote.

Students who accept a Direct Loan may also be required to complete a Master Promissory Note (MPN) to receive Federal Direct Loan(s). Clicking the link Electronic Master Promissory Note will direct the student to the site in order to complete this process.

First-time Borrowers

Before receiving a Federal Direct Loan, first-time borrowers at CSUSB must complete Entrance Counseling.

Interest Rates and Origination Fees

The interest rates vary based on the loan type and the disbursement date of the loan. They are fixed for the life of a loan. Borrowers will pay an origination fee that is deducted proportionately from each loan disbursement.

On August 2, 2011, Congress passed the Budget Control Act of 2011, which puts into place automatic budget cuts known as “sequester”. For Direct Loans, the sequester process does not change the amount, terms, or conditions of Direct Loans. Sequester directly impacts the amount of origination (processing) fees for a loan. The origination fee is determined by the first disbursement date, which is October 1st. Therefore, any loan with a primary disbursement date on or after October 1st will have its origination fee percentage adjusted.

Loan Limits

Federal Direct Loans have annual and aggregate borrowing limits. Annual limits are based on a student’s academic level and dependency status. Aggregate borrowing limits are based on a student’s Undergraduate or Graduate classification.

Graduating seniors who will attend college for less than a full year and graduate will have their Direct Subsidized and Unsubsidized Loans prorated based upon the number of enrolled units at CSUSB during the year.

Students seeking certificates, excluding Credential, must be admitted to a program that is a minimum of one academic year in length to be eligible for Direct Subsidized and Unsubsidized Loans. Students in programs that are shorter than an academic year in length are not eligible for financial aid.

Annual and Aggregate Loan Limit Chart

Repayment of Loans

After a student graduates, leaves school, or drops below half-time enrollment, he/she has a 6-month grace period before loans enter into active repayment. The repayment period for Stafford Loans varies from 10 to 25 years.

When it comes time to repay loans, students can choose a Repayment Plan that is best suited to their financial situation.

Additionally, all students who are departing from the University and have borrowed loan funds are required to complete Exit Counseling.

Managing Loans

It is important that borrowers keep track of their student loans and how much has been borrowed at CSU San Bernardino and other institutions they may have attended. The amount a student borrows as an investment in his/her education can quickly add up. Borrowers may access their student loan history and their servicer’s contact information through the National Student Loan Data System (NSLDS) website.

The Direct Loans a student borrows are maintained by a third party loan servicer on behalf of the Department of Education. A loan servicer is a company or organization that handles the billing and other services on student loans. The majority of the loan servicers for the Department of Education have web portals that allow borrowers to access and maintain their current information, make payments, and communicate directly with them. It is important that a borrower knows who their loan servicer is. A borrower can locate a listing of all loan servicers via the the Federal Student Aid site.

Additional Information

Direct Loan Basics For Students

Your Federal Student Loans: Learn the Basics and Manage Your Debt

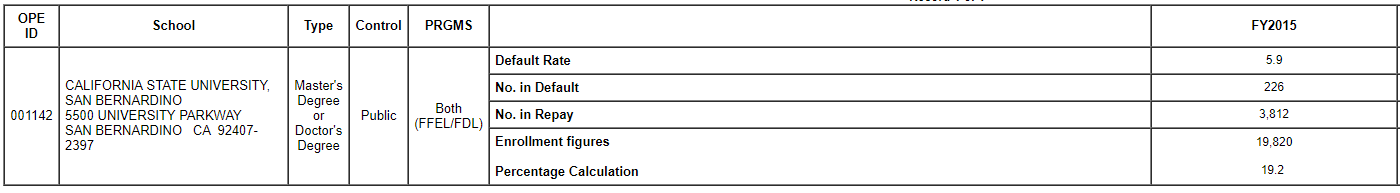

Federal Direct Student Loan Cohort Default Rate Information

A cohort default rate is the percentage of a school's borrowers who enter repayment on certain Federal Family Education Loan (FFEL) Program or William D. Ford Federal Direct Loan (Direct Loan) Program loans during a particular federal fiscal year (FY), October 1 to September 30, and default or meet other specified conditions prior to the end of the second following fiscal year. Please refer to the Cohort Default Rate information below for a more in-depth description of cohort default rates and how the rates are calculated. The U.S. Department of Educations Secretary announced that the FY 2015 national rate is 10.8%. CSUSB ensures that all borrowers receive entrance counseling to educate students on their rights and responsibilities. Students are also required to complete an exit couseling session prior to separation from the University.