Hospitality Policy

For interpretation of this policy, please contact the responsible department: Associate Vice President of Finance, Technology and Operations, 909/537-5129

Purpose

It is the policy of California State University San Bernardino (CSUSB) and its auxiliaries (Auxiliaries), unless otherwise noted and together referred to as the “University” that hospitality expenses may be paid to the extent that such expenses are necessary, appropriate to the occasion, reasonable in amount and serve a purpose consistent with the mission and fiduciary responsibilities of the University. This policy applies to employees, students, donors, guests, visitors, volunteers, and other individuals as part of a business meeting; recreational, sporting or entertainment event; or other occasion that promotes the mission of the University and serves a bona fide business purpose. The policy also addresses meals served to employees and meals provided to prospective students and employees.

Scope

This policy applies to all campus business units within the CSUSB and supersedes any practices in existence prior to its effective date. This policy governs the appropriate use of state and auxiliary organizations. CSUSB and its auxiliary organizations will comply with additional restrictions when established by funding sources.

Authority

Authority for this policy is pursuant to California Education Code section 89044. This policy is issued under delegation of authority from the Chancellor to the Executive Vice Chancellor and Chief Financial Officer, and implementation and compliance with the policy is further delegated to the campus Chief Financial Officer. California Education Code sections 66600, 89030, and 89035. In compliance with the ICSUAM policy, section 1301.00.

Definitions

Approving Authority – a person to whom authority has been delegated in writing to approve expenses for meals, light refreshments, and other amenities described within the policy.

Auxiliary Organization Funds – CSU auxiliary organizations are separate legal entities authorized in the Education Code to provide essential services to students and employees. Auxiliary organizations operate in association with campuses pursuant to special written agreements and are authorized to perform specific functions that contribute to the educational mission of the campus. These organizations are subject to applicable state and federal laws and regulations.

Campus Catering – The contracted on-campus caterer serves as the preferred vendor for all university-related catering at on-campus events. The campus caterer is also known as “Yotie Eats”.

De Minimis – small in value, relative to the value of total compensation. There is no set dollar amount in the law for nominal prizes or awards. The de minimis value for this specific policy is $75.00 per person.

Employee Meetings – meetings which serve a CSU business purpose and are generally administrative in nature such as staff meetings, CSU system wide meetings of functional offices, meetings of the Academic Senate, campus meetings of deans and directors, employee morale functions, extended formal training sessions, conferences, extended strategic planning sessions, and meetings of appointed workgroups and committees. Does not include one on one lunches or group working lunches when the meeting could otherwise be completed during the regular business day.

Events and Recognition – Events which serve a CSU business purpose and are in acknowledgement of milestones, significant contributions and employee recognition are generally allowable.

- Awards and Prizes

- Awards: Considered something of financial value given or bestowed upon an individual, group, or entity in recognition of service to the university or achievement benefiting the university with the expectation of a benefit accruing to the university or for other occasions that serve a bona fide business purpose. There may be a tax reportable requirement to the individual recipient. Awards are also defined as a plaque, certificate or trophy. If the plaque or certificate is of minimal value and solely symbolic (e.g., a modest plaque or paper certificate), it’s typically not tax reportable. If the award involves something of significant value or is coupled with a more substantial reward (like a high-value trophy or associated prize), it could be tax reportable to the individual recipient.

- Prize: A prize is something given to an individual or group in recognition of achievement, performance, or participation in a contest, competition, or event. Prizes can take various forms, such as cash, gifts, vouchers, trophies, or other tangible goods, and are typically provided as a form of incentive, reward, or acknowledgment. Prizes are often associated with accomplishments in areas like academics, athletics, business, or community activities and can vary in value depending on the context or significance of the achievement. There may be a tax reportable requirement to the individual recipient.

- Events, Recognition, Entertainment

- Reasonable expenditures as part of a public purpose event includes, but is not limited to:

- Equipment Rental

- Venue Rental

- Décor

- Supplies

- Music

- Guest Speakers and Presenters

- Reasonable expenditures as part of a public purpose event includes, but is not limited to:

- Food and Beverage

- Reasonable provision of a:

- Meal (catered or restaurant)

- Light refreshments (beverages, hors d'oeuvres, pastries, candy and cookies).

- Reasonable provision of a:

Fundraising Events

- Events conducted for the sole or primary purpose of raising charitable funds where participants make a charitable contribution and a purchase for the fair market value of goods or services. Examples of fundraising events could include dinners, dances, sales of merchandise, concerts, carnivals, golf tournaments, auctions, casino nights, and similar events. Fundraising events must have prior approval by the Vice President of University Advancement, per ICSUAM 15701.00 https://calstate.policystat.com/policy/12960514/latest

- Examples that are not considered fundraising events:

- Activities substantially related to the accomplishment of the CSU’s educational purpose, including such activities that receive sponsorship.

- Fundraising solicitations and related prospecting activities intended to generate only a contribution (no purchase of goods or services)

- Unrelated trade or business activities that generate fees for service.

- Raffles in which the prizes have only a nominal value and do not require reporting as taxable income.

Promotional Items

- Promotional items are defined as custom branded products or materials used by the University to promote the CSUSB brand, increase visibility, and engage with potential students, and donors.

- Items that display the name, logo or other icon identifying the university such as a:

- Keychain

- Coffee mug

- Calendar

- Campus Gear Wear/Apparel

- Promotional items are distributed to provide information and/or promote the name or image of the University.

- Clothing designed to identify campus employees and students working at a public campus event so that the general public can distinguish them as representatives of the campus, includes, but is not limited to safety, special event functions or specific groups or departments. Examples include events such as Commencement, Summer Orientation, and Diversity recognition. These purchases will be treated as regular business expenses and will not be subject to this procedure. Follow campus procedures for the procurement of goods.

- Logo and related branding must be pre-approved by Marketing and Communications.

Hospitality – Hospitality primarily involves providing food, refreshments, promotional items, and décor in social or business settings to enhance the experience of guests or attendees. It is often associated with events, meetings, or occasions where individuals gather for a specific purpose, such as employee meetings, recognition events, or donor cultivation. The focus of hospitality is on creating a welcoming and enjoyable environment for guests, and it is often used as a means of building relationships, recognition, or engagement that serve a specific business purpose consistent with the mission and fiduciary responsibilities of the University.

Membership in Social Organizations – University clubs, athletic clubs, civic organizations, and other membership organizations that provide a venue for hosting hospitality events or a means for promoting goodwill in the community. Memberships in business leagues, chambers of commerce, trade associations and professional organizations are considered a regular business expense and are not governed by this procedure.

Official Host – a CSU trustee, auxiliary governing board member, or university or auxiliary employee who hosts guests at a meeting, conference, reception, activity, or event for the active conduct of CSU business.

Official Guest – a person invited by an official host to attend a CSU meeting, conference, reception, activity or event. Examples of official guests include employees visiting from another work location, students, donors, recruitment candidates, volunteers, members of the community, or media representatives.

Public Purpose - A business purpose, which includes expenses, that serve a purpose consistent with the mission and fiduciary responsibilities of the CSU.

Private-Purpose Trust and Agency Funds - as defined by Executive Order (EO) 1000.

State Funds – These are monies that are either appropriated by the legislature, as part of the budget process or continuously appropriated (e.g., tuition and fees).

Sponsored Program Administration (SPA) Funds - Federal, state, local government, and private contracts.

Student Organizations - As defined in Executive Order (EO) 1068 – Student Activities, section titled "Formal Chartering and Recognition Policies."

Sustenance - Unlike Hospitality, sustenance refers to the provision of food and nourishment for basic human needs. Sustenance programs are aimed at meeting essential nutritional requirements rather than providing for social or ceremonial purposes.

Sustenance is often provided in situations where individuals require nourishment for their well-being or as part of a program or service aimed at supporting specific groups, such as students facing food insecurity, athletes during training sessions or competitions, or patients in the Student Heath Center who may require a beverage for hydration needs or nourishment after giving blood.

Unlike hospitality, sustenance is primarily focused on meeting fundamental needs rather than social or business objectives, therefore sustenance is not governed by this policy. Please review the “Sustenance Handbook” on the Accounts Payable or Procurement website.

Tip/Gratuity -A gratuity (also called a tip) is a sum of money customarily given by a client or customer to a service worker in addition to the basic price. Tipping is commonly given to certain service sector workers for a service performed, as opposed to money offered for a product or as part of a purchase price.

Work Location – The place where the major portion of an employee's working time is spent or the place to which the employee returns during working hours upon completion of special assignments. The employee's department determines what constitutes an individual employee's work location.

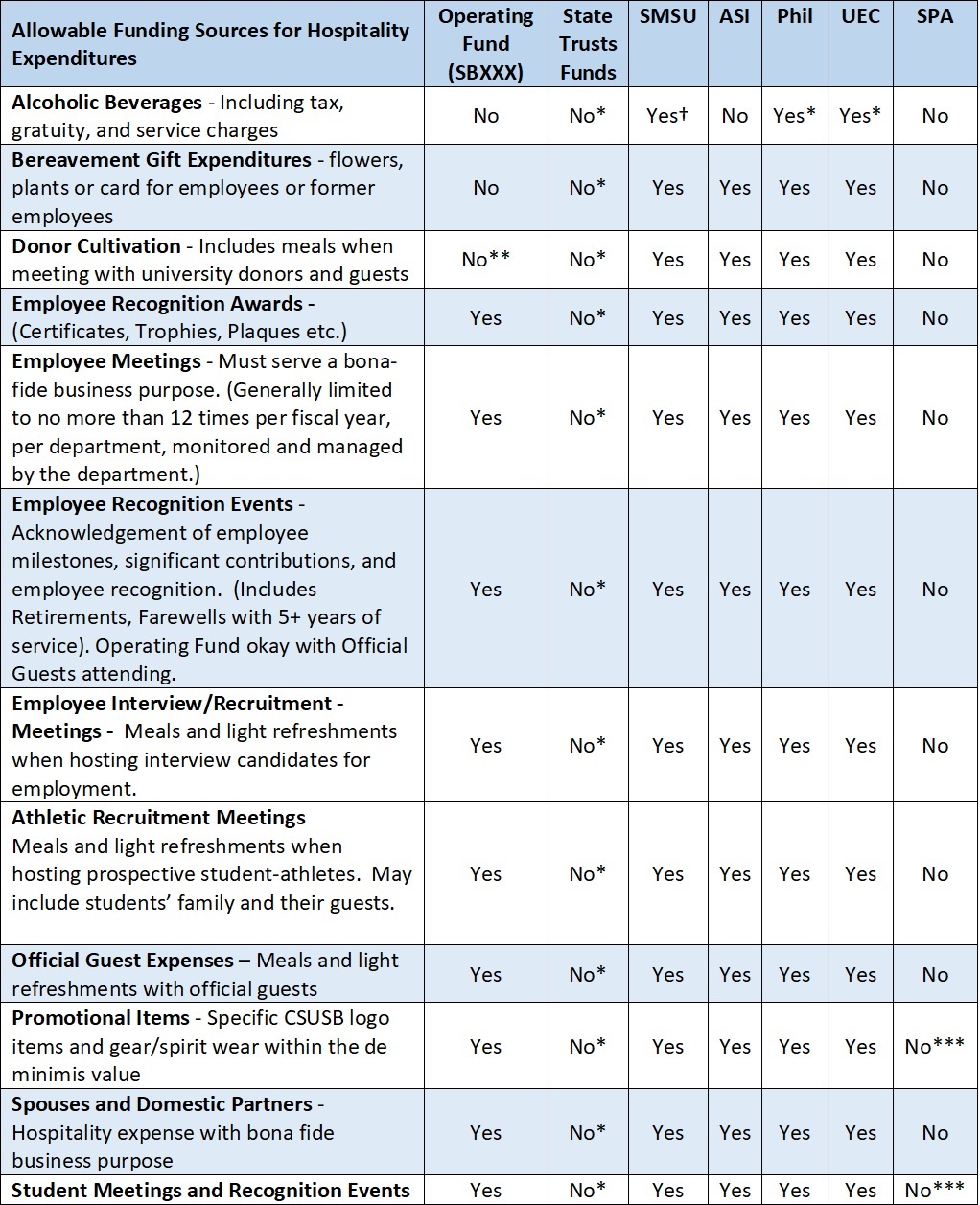

Allowable Expenditures

*Allowable when authorized by the trust fund. See trust fund for specific requirements and allowances.

**Use non-state resources.

*** Allowable if specifically identified/allowed in proposal budget.

†Only allowed with the approval of the SMSU Executive Director

Hospitality expenses must be directly related to, or associated with, the active conduct of official University business. When an employee acts as an official host, the occasion must, in the best judgment of the approving authority, serve a clear University business purpose, with no personal benefit derived by the official host or other employees. In addition, the expenditure of funds for hospitality should be cost effective and in accordance with the best use of public funds.

When determining whether a hospitality expense is appropriate, the approving authority must evaluate the importance of the event in terms of the costs that will be incurred, the benefits to be derived from such an expense, the availability of funds, and any alternatives that would be equally effective in accomplishing the desired objectives.

Awards and Prizes

Award programs may be established to the extent that such expenses serve a purpose consistent with the mission and fiduciary responsibilities of the CSU and aligns with IRS regulations. Cash and cash equivalent items, such as gift cards and gift certificates, no matter how small, are always taxable to the employee as wages.

A non-cash award or prize may have a taxable consequence to the employee if it does not meet the IRS definition of de minimis and infrequent. Only tangible goods with a retail value of less than $75.00 is considered de minimis.

It is the responsibility of the department awarding the prize to report the value to the Payroll Department.

Refer to IRS for tax rules: https://www.irs.gov/government-entities/federal-state-local-governments/de-minimis-fringe-benefits

Campus Catering – First Right of Refusal

For all on-campus events with food service exceeding $250, Campus Catering has the first right of refusal. No approval from Campus Catering is needed for on-campus events with food under $250, or for any off-campus events. Catering waiver form can be located on the Yotie Eats webpage under “catering”.

Employee Meetings

Meals or light refreshments provided to employees may be permitted if the expenses occur infrequently, are reasonable and appropriate to the business purpose.

When a meeting takes place over an extended period and the agenda includes a working meal, there may be justification that the meal is integral to the business function.

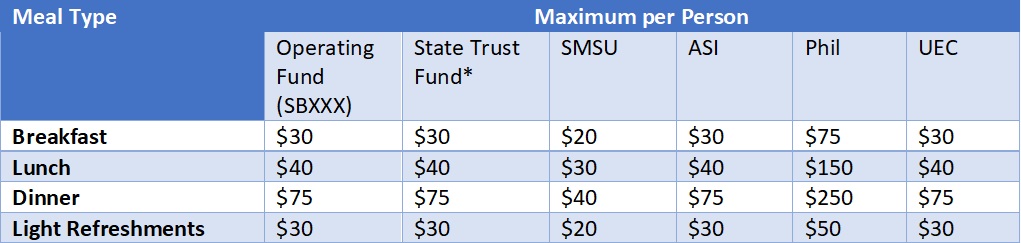

Meals – Maximum per Person Rates

See Hospitality Policy - Appendix “A”

Promotional Items to Employees

Providing promotional items with the campus logo to employees is generally allowable, but the circumstances and context are key. These items, such as shirts, hats, or mugs, are often part of employee recognition programs, campus events, or outreach efforts and are subject to specific guidelines related to spending public funds.

Key considerations include:

- Appropriate Use of Funds: Promotional items given to employees should be tied to university business purposes, such as enhancing employee morale, recognizing service or contributions, or supporting official university events. These usually require that funds used for these items come from appropriate sources, like discretionary funds or specific budget allocations that allow such expenditures.

- De Minimis Value: Items of nominal value (typically less than $75.00) are usually acceptable, as they fall under de minimis fringe benefits according to IRS guidelines. This means they are not significant enough to be considered taxable income for employees.

- Tax and Reporting: Items exceeding the de minimis threshold may be considered taxable to the employee and would need to be reported as part of their income.

- Conflict of Interest Policies: When offering promotional items, campuses must ensure they do not conflict with CSU’s conflict of interest policies, especially when involving state funds.

Promotional items must not imply endorsements of specific brands, especially in connection with certain industries like alcohol or other sensitive industries. This ensures that the university's name and branding remain consistent with its values and policies. When in question, please contact the Marketing and Communications Department for guidance.

Spouses, Domestic Partners, and Significant Others

Hospitality provided to the spouse, domestic partner or significant other of an employee may be permitted when it serves a university business purpose such as ceremonial functions, fundraising events, alumni gatherings, athletic games, and community events. An agenda, invitation or similar documentation must be included with the payment record.

Students and Prospective Students

Hospitality provided to students or prospective students may be permitted when it serves a university business purpose. To justify the expenditures, one must determine that the expenditure is consistent with the mission of the University. Permissible activities may include:

- Recruitment Efforts

- Student Activities

- Student Programs

- Student Organization Events

- Student Recognition Events and Commencements

Students may be hosted to attend fundraising and other community relations events that enhance their learning experience, in recognition of their student achievement, to engage with alumni and donors, or as representatives of elected student leadership.

Hospitality provided to student athletes and recruits must be in accordance with the rules, regulations, guidelines, standards and procedures of the intercollegiate athletic association’s national governing board, e.g., National Collegiate Athletic Association.

Tipping/Gratuities Guidance

It is recommended that users be reasonable (tips and gratuities should generally be 20% or less of the cost of the meal.

Unallowable Expenses

Personal Benefit

Hospitality expenses that are of a personal nature and not related to the active conduct of official University business will not be paid or reimbursed with state funding. The California gift of public funds doctrine set forth in the California Constitution, article XVI §6, prohibits the giving or lending of public [state] funds to any person or entity, public or private, unless there is a public purpose.

Examples include, but are not limited to:

- Employee Birthdays

- Weddings

- Wedding Anniversaries

- Baby Showers

Prepaid Meal Plans from On-Campus Dining

Purchasing prepaid meal plans from campus dining is not permitted. Financial controls require detailed tracking of expenses. Prepaid plans can obscure the trail of where funds are spent, which individuals benefited, and whether the funds were used appropriately for their intended purpose.

Allowable Funding Sources

State Funds

Unless specifically authorized in the local trust agreement (LTA), State Funds have the following restrictions and uses:

- State Funds may not be used:

- To pay for any expenditure prohibited by applicable laws, regulations, or agreements including the California Budget Act.

- To pay for food and beverages or entertainment services that do not serve a business purpose.

- To pay for alcoholic beverages, memberships in social organizations, or tobacco products.

- State Funds may be used:

- To pay for awards and prizes to employees for exceptional contributions, to students for excellence, and individuals to participate in research funded survey or study.

- For employee recognition, and official presentations for length of service awards or exceptional contributions, when the employee has at least 5 years of service.

- To pay for official employee morale-building and appreciation activities that serve a business purpose.

Auxiliary Organization Funds

Hospitality expenses may be charged to auxiliaries provided the expense serves a bona fide business purpose. Auxiliary organization funds may be used to pay for alcoholic beverages, formal awards and service recognition, entertainment services, gifts, membership in social organizations and promotional items to the extent these purchases are not restricted by other applicable laws, regulations, or funding source agreements.

Sponsored Programs Administration Funds

Federal or local government contract and grant funds may only be used to pay hospitality expenses specifically authorized in the contract or grant, or by agency policy. In the event of a conflict between agency and University policy, the stricter of the two policies shall apply.

Federal Funds may not be used to purchase alcoholic beverages or tobacco products, unless alcohol and tobacco are part of the research.

For specific Sponsored Program Administration Fund requirements, please see Sponsored Research Programs Administration. 305.0 Hospitality Policy_0.pdf (csusb.edu)

Private-Purpose Trust and Agency Funds

Hospitality expenses may be charged provided the expense serves a bona fide business purpose and to the extent other applicable laws, regulations, or funding source agreements do not restrict these purchases.

Purchase Order Requirements

Business Unit SBCMP and SBPHL:

- When purchasing from any vendor other than campus catering, or the approved vendor list, a Purchase Order will be required for anything exceeding $250.00. Submit the following to campus Purchasing with the Purchase Requisition:

- Approved Hospitality Worksheet

- List of Attendees and Attendee Affiliations to the University

- Agenda/Flyer/Invitation

Business Unit UEC

- When purchasing from any vendor other than campus catering, a Purchase Order will be required for any amount exceeding $10,000. Submit the following documents to the UEC Purchasing unit with the Purchase Requisition:

- Approved Hospitality Worksheet

- List of Attendees and Attendee Affiliations to the University

- Agenda/Flyer/Invitation

- Sole Source Form to establish a Purchase Order or three quotes

Business Units: SBASI

- When purchasing from any vendor other than campus catering, a Purchase Order will be required for any amount exceeding $10,000. Submit the following documents to the ASI Purchasing unit with the Purchase Requisition:

- Approved Hospitality Worksheet

- List of Attendees and Attendee Affiliations to the University

- Agenda/Flyer/Invitation

Business Units: SBSUN

- When purchasing from any vendor other than campus catering, a Purchase Order will be required for any amount exceeding $5,000. Submit the following documents to the SMSU Purchasing unit with the Purchase Requisition:

- Approved Hospitality Worksheet

- List of Attendees and Attendee Affiliations to the University

- Agenda/Flyer/Invitation

Invoices must be submitted to Accounts Payable, with the valid PO number on the face of the invoice for payment processing.

Employee Reimbursements

Any out-of-pocket expenses incurred by employees must follow the terms in this policy and be submitted to the campus Accounts Payable Office within 60 days after the expenses were paid or incurred. Per federal tax regulations, expenses submitted after 60 days may be reported as taxable income to the employee, and applicable Federal, State, FICA and Medicare taxes may be deducted from a subsequent salary check. Allowances are made when extenuating circumstances exist, such as employee illness, out of office during long term business travel, or in other situations where prior arrangements have been made with the Accounts Payable Office to postpone reconciliation and submission.

Timely reporting and submission of reimbursement claims is the responsibility of the employee being reimbursed regardless of whether the employee self-submits or has designated a delegate for expense reporting of reimbursements.

Approval of Transactions

The authorized MPP must approve payment or reimbursement of hospitality expenditures. If the authorized MPP is not available to sign, an authorized delegation of authority must exist.

State Side Approvals

Requirements that individuals with delegated approval authority may not approve their own expenses and individuals may not approve expenses of their supervisor. The exception is approval of President's expenditures by the Chief Financial Officer and Vice President, Finance, Technology and Operations.

Requirements that payment or reimbursement for attendance at a community relations activity or fundraising event include documentation of the individual names, affiliations, and direct or indirect benefit to the University to be derived from the expense.

The President, or designee must approve payment or reimbursement of hospitality expenditures for recreational, sporting or entertainment events.

The President, or designee must approve payment or reimbursement of hospitality expenditures for a spouse, domestic partner or significant other of an employee.

Auxiliary Approvals

Requirements that individuals with delegated approval authority may not approve their own expenses and individuals may not approve expenses of their supervisor. The exception is approval of President's expenditures by the Chief Financial Officer and Vice President, Finance, Technology and Operations.

A Hospitality Worksheet must be completed whenever food (breakfast, lunch, and/or dinner or light refreshments) are served for the purpose of extending hospitality in connection with CSUSB and/or Auxiliary business. Requirements that payment or reimbursement for attendance at a community relations activity or fundraising event include receipt(s) and/or invoice, agenda of the meeting, documentation of the individual names, affiliations, and direct or indirect benefit to the University to be derived from the expense.

Exceeding Meal Allowances as Defined in Appendix A

The Division Vice President may authorize exceeding the maximum per-person meal rates when necessary due to special circumstances such as high-cost areas, specific dietary needs, or event requirements that align with the university's business purpose. This exception must be documented, justified, and approved in writing, ensuring compliance with budgetary guidelines and policies.

Documentation Required

The following are required to formally support the expenditure:

- Hospitality Worksheet: All hospitality expenses must have a completed hospitality worksheet form submitted along with supporting backup documentation such as a quote, invoice, and original receipt when requesting payment or reimbursement. Information required on the justification form includes:

- If the meeting is reoccurring.

- The business purpose of the meeting or event. The business purpose must be specific and provide enough information to a third-party reviewer to understand the nature and purpose of the meeting.

- Type of hospitality (meals/refreshments, service recognition, etc.)

- Location and date.

- The cost of the meal per attendee.

- For a large group where the names of attendees are unknown, a description of the group and estimated cost of the meal per attendee is sufficient.

- Campus Catering Waiver form is required when the following conditions exists:

- Meal cost exceeds $250.00

- Food is served on-campus by an outside source

- Events on campus require a Reservation ID number from Special Events and Guest Services.

- Environmental Health and Safety Department approval is required on the Food Event Notification Form when the following condition exists:

- Any food served on-campus by an outside caterer/source other than campus catering.

- Itemized Receipt

- Receipt of invoice from the vendor showing payment, or

- Lost Receipt Affidavit

- Agenda/Flyer/Invitation

- Listing of Attendees and Affiliations

- For a large group where the names of attendees are unknown, a description of the group and estimated cost of the meal per attendee is sufficient.

- Campus Catering

- Itemized Invoice

- Catering (Other than Campus Catering)

- Purchase Order Requisition submitted to the appropriate Purchasing unit and in compliance with their guidelines:

- Approved Hospitality Form

- Itemized quote/invoice

- Listing of Attendees/agenda/flyer

- Submit invoice to Accounts Payable with PO number listed on the invoice.

- Purchase Order Requisition submitted to the appropriate Purchasing unit and in compliance with their guidelines:

- Corporate Card

- Please follow the Hospitality Policy procedures when submitting hospitality expenses using the Corporate Card or any auxiliary ProCard. All hospitality guidelines must be adhered to, regardless of the payment method used. For detailed information, refer to the Corporate Card Handbook or the auxiliary ProCard policy.

Modification to Meal Rates in Appendix A

Business units within the organization are permitted to update the meal reimbursement rates outlined in Appendix A of the hospitality policy. However, any adjustments or modifications to these rates must be approved by the respective Division Vice President before implementation. The Division Vice President will review and authorize any changes to ensure alignment with budgetary considerations and adherence to organizational guidelines. This clause aims to provide flexibility for business units while maintaining oversight and approval from the appropriate leadership level.

A memorandum from the Division Vice President should be submitted to the AVP of Finance, Technology and Operations to update the meal allowance table.

Resources

Corporate Card Handbook: Please navigate to the Procurement and Contracts website and locate the “Corporate Card Handbook”. https://www.csusb.edu/procurement

Lost Receipt Affidavit: Please navigate to the Accounts Payable website and locate the “Lost Receipt Affidavit” under “forms”. https://www.csusb.edu/accounts-payable

Hospitality Worksheet: Please navigate to the Accounts Payable website and locate the “Hospitality Worksheet” under “forms”. https://www.csusb.edu/accounts-payable

Hospitality Policy: Please navigate to the CSUSB Policies website and locate the “Hospitality Policy”. https://www.csusb.edu/policies

Appendix A

Meals – Maximum per Person Rates

The maximum per person rate(s) for breakfast, lunch, dinner, and light refreshments inclusive of the total cost of food, beverages, labor, sales tax, delivery fees, or other service fees are as follows:

* When authorized by the trust fund. See trust fund for specific requirements and allowances.

Meals – Out of Area/Travel Rates – Maximum per Person

The maximum per person rate(s) for breakfast, lunch, dinner and light refreshments inclusive of the total cost of food, beverages, labor, sales tax, delivery fees or other service fees for out of area travel may be obtained from the U.S. General Services Administration at the following link:

https://www.gsa.gov/travel/plan-book/per-diem-rates

Note that while the University policy has a daily limit, for the benefit of expense processing, it is recommended that each meal be broken out individually.