Alan Llavore | Office of Marketing and Communications | (909) 537-5007 | allavore@csusb.edu

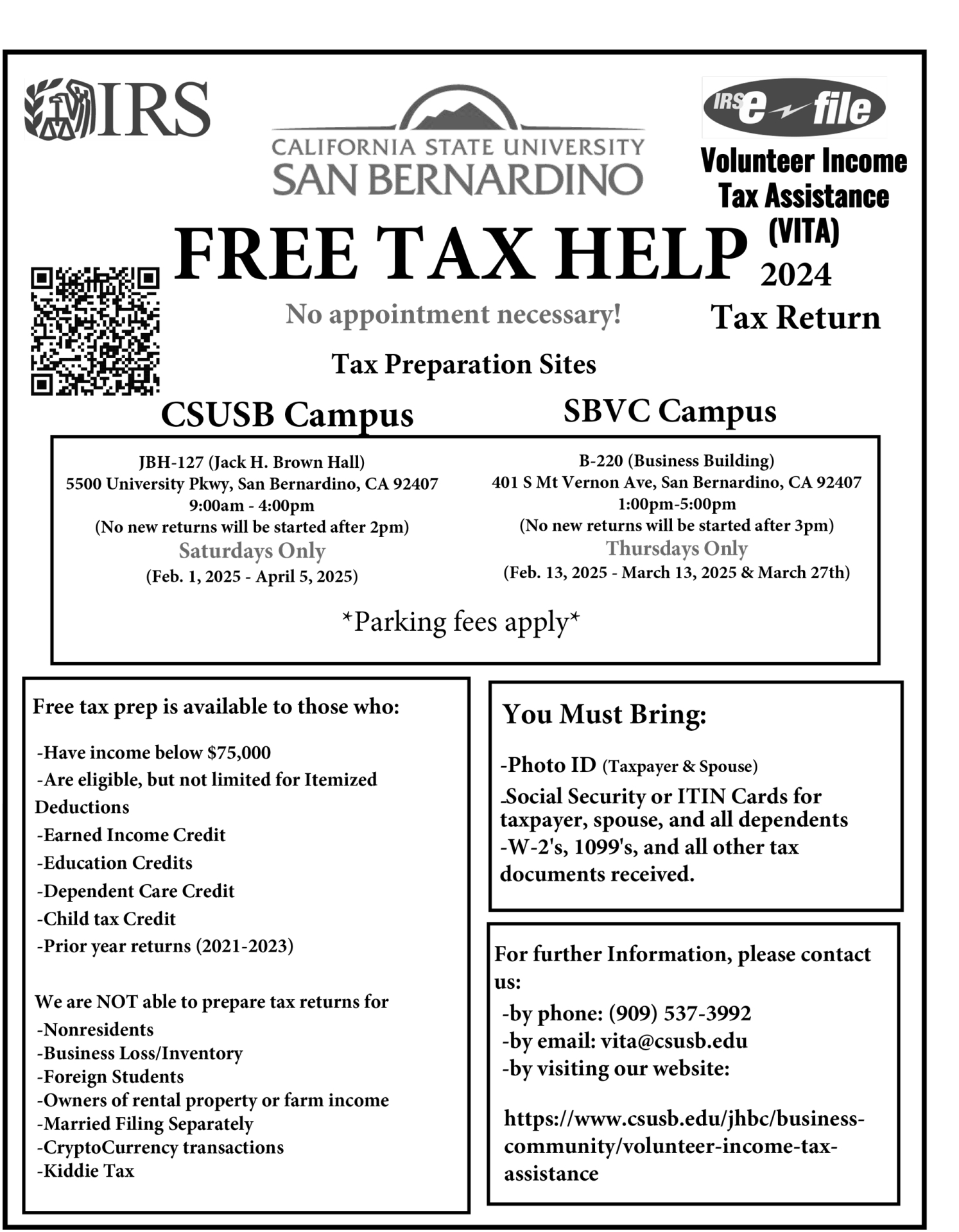

Cal State San Bernardino’s Jack H. Brown College of Business and Public Administration is gearing up for another tax season with its Volunteer Income Tax Assistance (VITA) program. Designed to support the San Bernardino community, the program provides free tax preparation services to low-income individuals and families, senior citizens, non-English speakers, and individuals with disabilities.

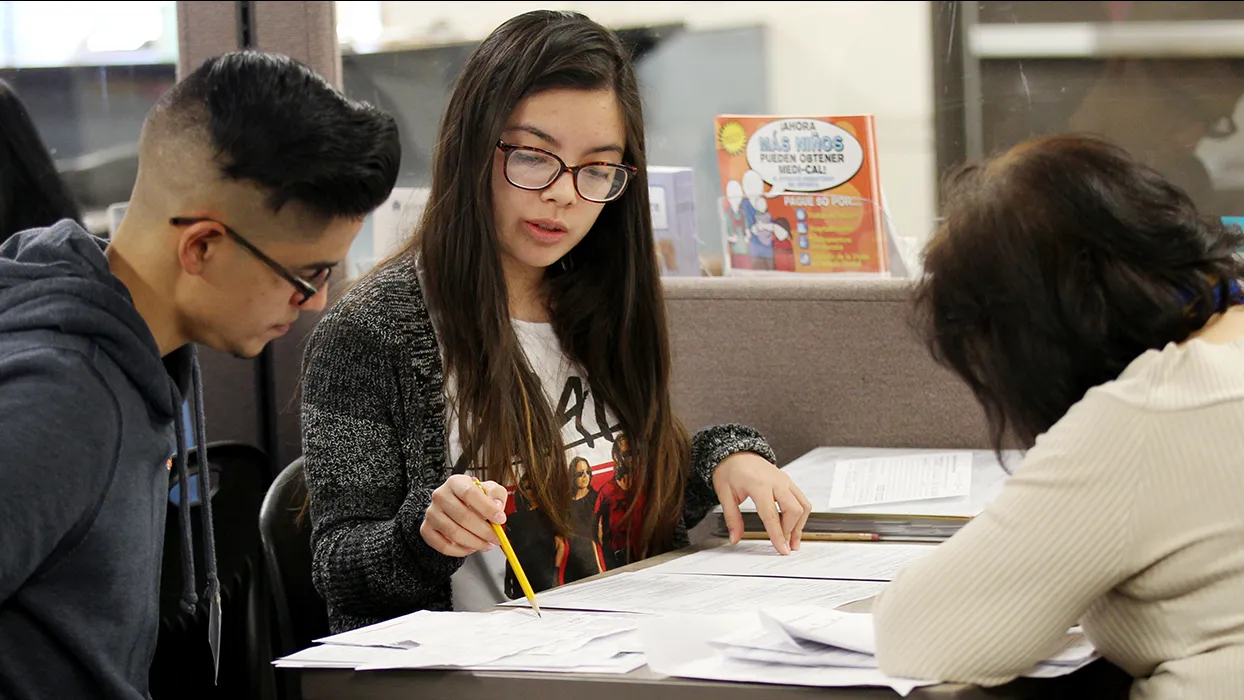

The VITA program is staffed by undergraduate and graduate accounting students who have completed IRS certification, gaining hands-on experience while assisting the community. The program is overseen by certified public accountants (CPAs) Sydnee Woodland and Tian Tian, who ensure accuracy and provide expert guidance to the student volunteers.

Participants should note that the program has certain limitations. The income cap for eligibility is $75,000, and the student volunteers are not certified to process returns for international students, nonresidents, or those involving cryptocurrency transactions.

The VITA program will be available starting Saturday, Feb. 1, through Saturday, April 5, at two locations. Services are offered on a walk-in basis on Saturdays from 9 a.m.-4 p.m. at Jack Brown Hall, room 127, on the CSUSB campus, as well as at San Bernardino Valley College on Thursdays from 1 p.m.-5 p.m. in the business college, room B-220.

For additional details, visit the VITA Program webpage.